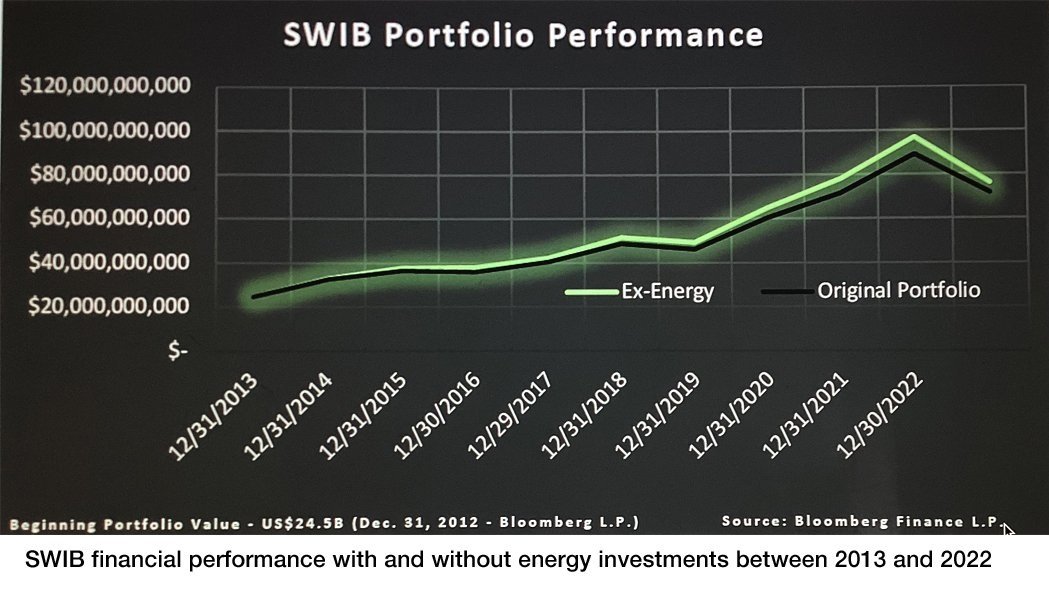

REPORT: State of Wisconsin Investment Board (SWIB) lost $4.3 billion by lingering in fossil fuel stocks the past ten years.

That means each Wisconsin Retirement System (WRS) member lost about $6,000.

“Influential investors, like these large public pension funds, can bring about positive change on a few fronts,” said Dr. Olaf Weber, professor and study author at the University of Waterloo. “Energy divestments can create higher returns for the funds, which leads to higher returns for the beneficiaries and reduced exposure to climate risks. Consequently, it leads to safer pensions.”

Documentation is within a new report (released on June 28, 2023) from the University of Waterloo and the Climate Safe Pensions Network.

Key point: that report substantiates why we have been trying to get SWIB to reconsider their investment choices. If SWIB had divested from fossil fuel stocks ten years ago SWIB would now be $4.3 billion dollars richer.

This groundbreaking report also reveals that just 6 public pensions lost $21 billion by failing to divest from fossil fuels ten years ago. The study examined the effect divesting from energy sector holdings would have had on investment returns and the benefits provided to over 3 million people who rely on their pensions.

A reasonable person would notice one other critical point: financing fossil fuel investments threaten not only our financial investments, but our health and the health of our communities and planet. It leads to catastrophic climate chaos, and increasing outbreaks of extreme weather.

Big picture: Isn’t it fundamental common sense and due diligence to be concerned about the carbon impacts of SWIB’s fossil fuel holdings?

If SWIB had divested a decade ago, the research documents that its portfolio would have produced 24.4% less carbon or 28.5 million less metric tons. According to the Environmental Protection Agency’s green house gas calculator that is the equivalent of the green house gas from 6.3 million gas-powered cars driven for one year.